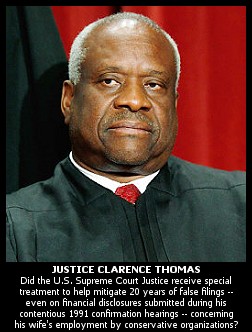

The words "EQUAL JUSTICE UNDER LAW" are famously chiseled above the main portico of the U.S. Supreme Court building in Washington D.C. But is one of the Justices seated in that building, with a lifetime appointment, now receiving special treatment under the law instead?

The words "EQUAL JUSTICE UNDER LAW" are famously chiseled above the main portico of the U.S. Supreme Court building in Washington D.C. But is one of the Justices seated in that building, with a lifetime appointment, now receiving special treatment under the law instead?

Evidence is mounting that U.S. Supreme Court Justice Clarence Thomas violated federal law by failing to report his wife's annual salary of more than $120,000 per year from conservative political organizations by checking "NONE" on the box for "Non-Investment Income" for his wife Virginia on judicial Financial Disclosure Reports for the last 20 years.

According to the "self-initiated amendment" letters [PDF] signed by Thomas as dated Friday, January 21, 2011, and stamped as "RECEIVED" by the Judicial Conference of the U.S. Committee on Financial Disclosure on a Saturday, January 22, 2011, the Justice failed to reveal such sources of spousal income even on his original nomination disclosure forms during his contentious 1991 confirmation hearings.

One of the amendments hastily filed last week by Thomas states that he "inadvertently omitted" spousal income from as far back as 1989 "due to a misunderstanding of filing instructions." Though it has also been reported that he did report other spousal income on some disclosure reports up until 1996.

Virginia Thomas' income from The Heritage Foundation, a conservative think-tank, totaling $686,589 from 2003 to 2007 according to Common Cause, was omitted from the forms entirely, as was her Heritage Foundation employment from 1998 to 2003 and other sources of "non-investment income" from as early as 1989.

When reached by phone for comment on Friday, two different officials at the Judicial Conference were particularly hostile in response to questions from The BRAD BLOG in regard to what appeared to be special treatment afforded the Supreme Court Justice, allowing him to deliver the amendment letters for twenty years of inaccurate financial disclosure forms on a Saturday when the federal government office is not usually open to the public. The swift processing of Thomas' documents, carried out as the news of his false filings was about to break in the media, allowed subsequent news reports to downplay the issue as having already been handled, old news.

Moreover, Thomas' 'inadvertent omissions' appear to be in violation of U.S. federal law, in contradiction to suggestions from the Los Angeles Times' original reporting on this matter last weekend. That report, breaking the story publicly, quoted a judicial ethics expert from Northwestern University School of Law as asserting that Thomas' failure to report his wife's income was "not a crime of any sort."

It would appear that the law professor was wrong.

Closer examination of the original disclosure forms that Thomas filed and signed year after year, quite directly suggests crimes were committed, though none of the mainstream corporate media reports on this issue, to our knowledge, have bothered to focus on that point. According to the statute clearly printed on the disclosure reports filed by Thomas, just below his signature on each, the Supreme Court Justice could be held accountable for his omissions by penalties under the U.S. Code including as much as a $50,000 fine and up to one year imprisonment, or both, for each violation of the federal law. Even stricter penalties are also a possibility --- at least if one believes that even U.S. Supreme Court Justices are subject to the Rule of Law...

'Not a Crime of Any Sort'?

Thomas has maintained that the omissions of his wife Virginia's "non-investment income" salary --- from the Heritage Foundation, the Liberty Coalition, a "Tea Party" political group she founded in 2009, and a number of Congressional Republicans for whom she work --- were "inadvertent." He quickly moved to file amendments to years of false disclosure reports as the governmental watchdog organization Common Cause sent a letter [PDF] to the Secretary of the Judicial Conference just over a week ago, seeking an investigation and possible referral to the Attorney General, and as the Los Angeles Times worked on breaking their story that weekend.

The Times article included a quote from Northwestern University School of Law professor, Steven Lubet, downplaying the seriousness of the apparent violations of law, by stating his belief that they were "not a crime of any sort":

However, the disclosure forms (here is the one he filed for 2009 [PDF], for example, as submitted in 2010) as signed by Thomas in the final "Certification" section, attests that the information provided on the report, "including information pertaining to my spouse," was "accurate, true, and complete to the best of my knowledge and belief."

The penalties for falsifying those documents are noted in ALL CAPS on the Financial Disclosure Report itself, just below the Justice's own signature as follows:

The statute referenced there, 5 U.S.C. app. § 104, defines the "civil and criminal sanctions" for "knowingly and willfully falsif[ying]" the report, including a fine "not to exceed $50,000" and "imprison[ment] for not more than 1 year, or both" for each instance [emphasis added]:

(1) The Attorney General may bring a civil action in any appropriate United States district court against any individual who knowingly and willfully falsifies or who knowingly and willfully fails to file or report any information that such individual is required to report pursuant to section 102. The court in which such action is brought may assess against such individual a civil penalty in any amount, not to exceed $50,000.

(2)

(A) It shall be unlawful for any person to knowingly and willfully

(i) falsify any information that such person is required to report under section 102; and

(ii) fail to file or report any information that such person is required to report under section 102.

(B) Any person who

(i) violates subparagraph (A)(i) shall be fined under title 18, United States Code, imprisoned for not more than 1 year, or both; and

(ii) violates subparagraph (A)(ii) shall be fined under title 18, United States Code.

The penalties spelled out above reference title 18 of the United States Code as well. Both Roger Shuler at Legal Schnauzer and "AlaskaDave" at Daily Kos have detailed what is referenced by that statute, and how it pertains to the Ethics in Government Act (EGA) as instituted following Watergate.

Both writers cite an article posted at the Mississippi Criminal Defense Blog last January, as written by Mississippi attorney Clarence Guthrie in reference to an FBI agent in the state who was indicted "for making false official statements to a federal official." Here's Guthrie:

1. knowingly and willfully;

2. make any materially false, fictitious or fraudulent statement or representation;

3. in any matter within the jurisdiction of the executive, legislative or judicial branch of the United States.

This was the charge that Martha Stewart served time for. It is a crime to tell a lie to the federal government. Even if your lie is oral and not under oath, and even if you have received no Miranda warnings of any kind. You must know that your statement is false at the time you make it, but you do not have to know that lying to the government is a crime. Any person convicted under this statute faces statutory penalties of a possible fine, and up to 5-8 years in prison.

So you may add the possibility of 5 to 8 years in prison, to the 1 year mentioned in the specific statute printed on the form below Thomas' signature, for each of his apparent violations, if he was to be charged and found guilty.

As "AlaskaDave" points out:

While there is no doubt an argument to be made that this conduct is just a misdemeanor, take a look at UNITED STATES v. WOODWARD, 469 U.S. 105 (1985) where a person checking the "no" box on a custom form was punished both for the false statement (18 USC 1001) violation and the charge of failing to report the currency itself --- all as a result of checking the "no" box.

Personally I don't like the law, and for that matter neither does Martha Stewart who was convicted for a violation of 18 USC 1001, but it is the law and if a US Supreme Court Justice can't seem to figure it out year after year, perhaps he should suffer the consequences as so many others have.

The Financial Disclosure Reports submitted by Thomas are quite simple and straight forward, including Section III B for "Spouse's Non-Investment Income" where Thomas checked "NONE (No reportable non-investment income.)."

As noted by NYU School of Law professor Stephen Gillers in the LA Times' report, "It wasn't a miscalculation; he simply omitted his wife's source of income for six years, which is a rather dramatic omission." He added, "It could not have been an oversight."

[Note: Since the LA Times' initial report, additional disclosures reveal that Thomas withheld such information not for just six years, but for as many as twenty, even while he was deciding cases such as Citizens United v. Federal Election Commission, which had a very direct impact on the fund-raising ability of organizations such as The Heritage Foundation and his wife's Liberty Coalition. In short, they stand to make hundreds of thousands, even millions, as based on the decision in the case, in which Thomas supported the majority decision.]

Common Cause President Bob Edgar characterized Thomas' claims that there was a "misunderstanding of the filing instructions," as stated on his "self-initiated amendments," as "difficult to believe" and "implausible."

Common Cause President Bob Edgar characterized Thomas' claims that there was a "misunderstanding of the filing instructions," as stated on his "self-initiated amendments," as "difficult to believe" and "implausible."

"Justice Thomas sits on the highest court of the land, is called upon daily to understand and interpret the most complicated legal issues of our day and makes decisions that affect millions," he said in a Commom Cause statement issued last week. "It is hard to see how he could have misunderstood the simple directions of a federal disclosure form. We find his excuse is implausible."

Thomas' claims become even more "implausible" when considering, as AP reported, that he did succeed in including his wife's employment on many of those very same disclosure reports filed prior to 1996.

Moreover, as noted in a Press Release issued last week by ProtectOurElections.org calling on Thomas to step down and for charges to be brought against him, the Justice's presumed expertise in law, according to prosecutorial guidelines in the Dept. of Justice's Handbook on Prosecution, means that he is presumed to have acted "knowingly and willfully," as per the statute noted on the disclosure report, when he signed and submitted the forms failing to list the organizations paying hundreds of thousands of dollars of salary to his wife.

A defendant's signature on such documents in criminal prosecutions, says the DoJ, can also be used to "help to establish willfulness."

[DISCLOSURE: ProtectOurElections.org is a campaign run by VelvetRevolution.us, an organization co-founded by The BRAD BLOG.]

The ProtectOurElections.org statement notes a number of other recent cases where defendants were given stiff penalties in a court of law for having falsified financial documents.

Their attorney, Kevin Zeese, says "Justice Thomas admitted that he made false statements on 20 years of disclosure forms, but that it was just a simple misunderstanding. How many criminal defendants have said the same thing but were not offered the same opportunity to correct or amend their statements before being prosecuted?"

"How many cases has Justice Thomas sat in judgment of where people were charged with similar conduct? How many lawyers would have asked for Justice Thomas's recusal had the disclosure forms been accurate?" he continued.

Zeese observes: "Supreme Court Justices are supposed to know the law. Yet, Justice Thomas wants to be treated differently than others who committed similar conduct. His 'misunderstanding' excuse should be argued before a federal jury rather than to a committee that has no authority to grant him immunity from prosecution."

On the heels of the initial Los Angeles Time' report, downplaying the seriousness of these violations by the inclusion of Northwestern University law professor Lubet's comment that Thomas' transgressions were "not a crime of any sort," much of the mainstream media seemed to yawn at the news.

We shared much of the information above, twice, including the details on the actual criminal statutes, via email with Lubet to see if he'd like to modify his assessment in light of it. We also left voice messages a number of times, but we've yet to hear back from him. We will update this item appropriately when and if we do.

But that was not the only reason, it seems, that the corporate media may have spent very little time looking into 20 years of false filings by a U.S. Supreme Court Justice...

Special Treatment For Thomas by the U.S. Judicial Conference Committee?

After reviewing copies of Thomas' amendments [PDF], hastily sent to the U.S. Judicial Conference Committee on Financial Disclosure, as obtained via public records request, we noticed a couple of interesting issues.

After reviewing copies of Thomas' amendments [PDF], hastily sent to the U.S. Judicial Conference Committee on Financial Disclosure, as obtained via public records request, we noticed a couple of interesting issues.

First, Thomas' "self-initiated amendments" included not only the omitted details from the Financial Disclosure Reports on his wife's income from the The Heritage Foundation and Liberty Coalition from 2004 through 2009, but also on forms going back as far as 1990, his "Nomination Financial Disclosure Reports" during his famously contentious nomination hearings in 1991.

Secondly, all seven amendment letters included in response to the records request, are dated January 21, 2011, the same date as the original Common Cause letter to the Secretary of the U.S. Judicial Conference seeking a finding and possible referral to the AG on this matter. The Los Angeles Times story was published in their January 22, edition.

Clearly, Thomas scrambled to amend 20 years of false reports as Common Cause and the Times, who almost certainly contacted him for comment, prepared their reports. That quick work paid off, as most of the subsequent reports on the matter by corporate mainstream outlets were able to downplay the matter since, after all, Thomas had quickly amended the filings (once he got caught.) Problem solved!

USA Today's first report was that "Clarence Thomas fixes reports to include wife's pay". The Wall Street Journal was able to tell readers that "Justice Thomas Revises Disclosures After Criticism". And Washington Post/AP reported only that "Thomas adds wife's employment to disclosure report."

None of the reports offered detailed information on the possible violations of the law as we've spelled out above.

We found it interesting that Thomas' amendment letters, dated Friday the 21st, were stamped as "RECEIVED" on Saturday, January 22nd and wondered if, perhaps, he had received special treatment in processing his letters quickly on a Saturday, prior to the LA Times' initial report, when federal offices are normally not open for business.

We made several calls last week to officials at the Judicial Conference to find out if receiving such materials on Saturday is normal or if special accommodations were made just for Thomas. A receptionist confirmed that the Financial Disclosure office, like most federal offices, is not generally open for public business on Saturday.

In seeking more details, we were transferred to George Reynolds, Staff Counsel for the Judicial Conference Committee on Financial Disclosure. The discussion was terse, as Reynolds would not directly answer whether the Supreme Court Justice had received any sort of special treatment for his filings.

"We try to accommodate all filers at different times," Reynolds told us sharply. "If someone needs our help and we can provide it, why not? Isn't the idea to get the forms and to make them available?"

He claimed that it was "not unusual" to process such information on a weekend, as long as personnel is in the office already and available to do so. "We aren't routinely here on a Saturday," he explained, before adding that he "had someone who was working here on Saturday, so that made it easy" to handle Thomas' amendments quickly.

"We got the request that they wanted to file the amendment. If they know ahead of time, we try again to accommodate everybody. Why not help them?" he said.

When we asked for further details about when the request came, and whether or not someone came in expressly to receive Thomas' documents, he refused to answer any more questions and referred us to the Committee's Public Affairs Director, David Sellers.

Sellers was even shorter with us than Reynolds, and ended up hanging up the phone after just a minute or two of our trying to clarify the situation.

"I think you're trying to make something out of nothing here," he said in response to rather polite questions about whether or not someone made a special effort to receive Thomas' document on a weekend. "I don't have anything to say," the Public Affairs official repeated at least twice.

"I don't know if there were people who were there or not, there are people who work here on weekends."

In trying to learn if any member of the general public, or even another member of the judiciary, would be able to walk in on a Saturday and receive service at the agency, we were abruptly cut off before we were able to even finish the question.

"I think I see where you're going with this and you have an agenda," Sellers snapped accusingly. "That's clear from every question you ask, and so I think I'm gonna end this conversation. We're available to assist filers and that's our job, so we do it any way that we can. So, thank you."

And then Sellers hung up the phone on us. The call with the Public Affairs Director lasted, in total, no more than three minutes.

CORRECTION: This story, as original published, referenced the case of Missisippi FBI agent Hal Neilsen as having been charged under 18 U.S. Code 1001 in January of this year. In fact, his indictment occurred last year, in January of 2010. The article above has been corrected to reflect the accurate date of that case.

Documents...

- Thomas' 2010 Financial Disclosure Report for 2009 [PDF]

- Thomas' "Self-Initiated Amendments" [PDF] (Dated 1/21/11, "Received" 1/22/11) to 20 years of inaccurate Financial Disclosure Reports

ProtectionOurElections.org's video release on the Clarence Thomas financial disclosure failures follows below...

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 'Green News Report' 4/29/25

'Green News Report' 4/29/25

And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Sunday 'Desperation' Toons

Sunday 'Desperation' Toons Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25 'Green News Report' 4/24/25

'Green News Report' 4/24/25 Nation's Largest Broadcaster Hoaxes Viewers to Help Gut FCC Rules: 'BradCast' 4/23/25

Nation's Largest Broadcaster Hoaxes Viewers to Help Gut FCC Rules: 'BradCast' 4/23/25 Trump's FCC on Precipice of Ending All Limits on Corporate Control of Local TV Stations

Trump's FCC on Precipice of Ending All Limits on Corporate Control of Local TV Stations GOP Earth Day 2025 Hypocrisies and Dilemmas: 'BradCast' 4/22/25

GOP Earth Day 2025 Hypocrisies and Dilemmas: 'BradCast' 4/22/25 'Green News Report' 4/22/25

'Green News Report' 4/22/25 Pope Francis Dies, Trump Still Alive and Criming: 'BradCast' 4/21/25

Pope Francis Dies, Trump Still Alive and Criming: 'BradCast' 4/21/25 Sunday

Sunday  Sunday 'Zero Day' Toons

Sunday 'Zero Day' Toons 'Green News Report' 4/10/25

'Green News Report' 4/10/25 Soc. Sec. Expert Warns DOGE of Collapse, Privatization: 'BradCast' 4/10/2025

Soc. Sec. Expert Warns DOGE of Collapse, Privatization: 'BradCast' 4/10/2025 Trump Blinks, Chaos Reigns, Markets Spike Amid Tariff 'Pause': 'BradCast' 4/9/25

Trump Blinks, Chaos Reigns, Markets Spike Amid Tariff 'Pause': 'BradCast' 4/9/25 SCOTUS Deportation Ruling Grimmer Than First Appears: 'BradCast' 4/8/25

SCOTUS Deportation Ruling Grimmer Than First Appears: 'BradCast' 4/8/25 Cliff Diving with Donald: 'BradCast' 4/7/25

Cliff Diving with Donald: 'BradCast' 4/7/25 'Mob Boss' Trump's Trade Sanctions Tank U.S., World Markets: 'BradCast' 4/3/25

'Mob Boss' Trump's Trade Sanctions Tank U.S., World Markets: 'BradCast' 4/3/25 Crawford Landslide in WI; Booker Makes History in U.S. Senate: 'BradCast' 4/2/25

Crawford Landslide in WI; Booker Makes History in U.S. Senate: 'BradCast' 4/2/25 Judge Ends Challenge to GA's Unverifiable, Insecure Vote System: 'BradCast' 4/1/25

Judge Ends Challenge to GA's Unverifiable, Insecure Vote System: 'BradCast' 4/1/25 Bad Court, Election News for Trump is Good News for U.S.: 'BradCast' 3/31

Bad Court, Election News for Trump is Good News for U.S.: 'BradCast' 3/31

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL